Ladies and gentlemen welcome in Finance With Teo blog.

Here we will talk about money, investment, habits and mental model. It’s a space for discussion where we will try to distill the best strategy and tatics from first priciples. Stay tune and let me know any feedback in the comment.

Let’s the journey begin!

From where can we start?

From talking about making money? It’s fine for you?

Making money it’s really a big topic. We will have dedicated articles for it.

For now, just some math behing making money..

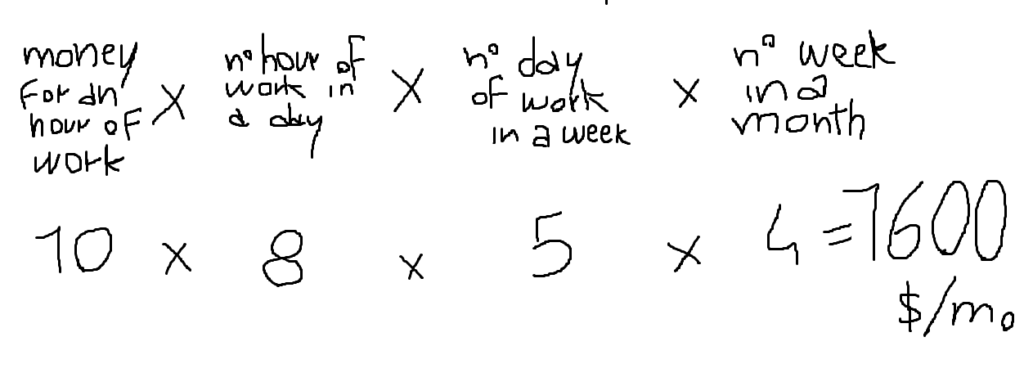

When you sell your time, this is the math:

Can you see the bottle neck in this math? It’s the time. You can only work a limited n° of hour in a day.

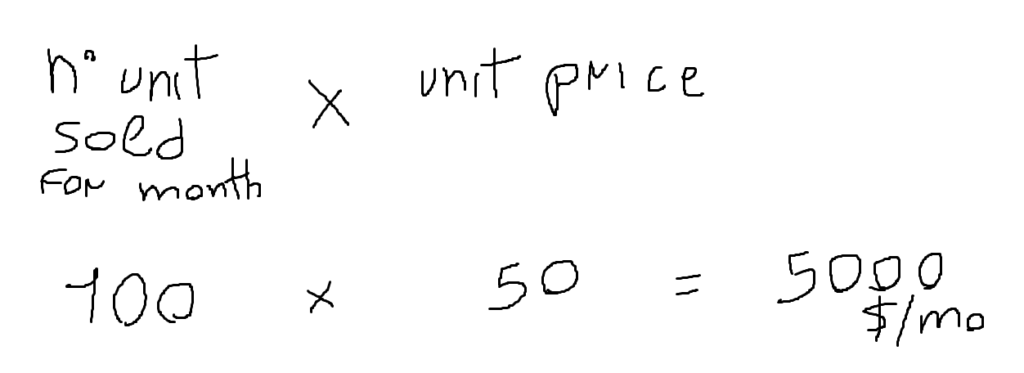

Another formula for making money is:

Here you have 2 bottle neck, but no depency from time. The second type of income is more scalable. But it will take you more effort initially, because you need to build a product and/ or a service that solve a problem for someone else. Funny, generosity is good also for you. Help solve other people problem and you will make more money. And sometimes you can start by solving your own problems. Others people might have the same problem you have.

Money = value ticket that you get when you solve other people problems.

So you sell your time or a product/service and you save some money and then you can invest. But why waiting for the money if you do not have some? it’s possible to aquire the neccessary knowledge for investing before you will have the big bucks (if ever, but I belive in you). You can start investing with little money, so you can learn about this world. That’s what I’m doing.

You work your ass off, you gain some revenue every month, and what do you do?

Where can you invest those money? How much should you invest?

All this questions depends on you and your personal goals, everyone has differents goals and desire, so there are not a precise investment plan for anyone. The best thing is to lean as much as you can so you can judge stuff by yourself and you will not be fooled.

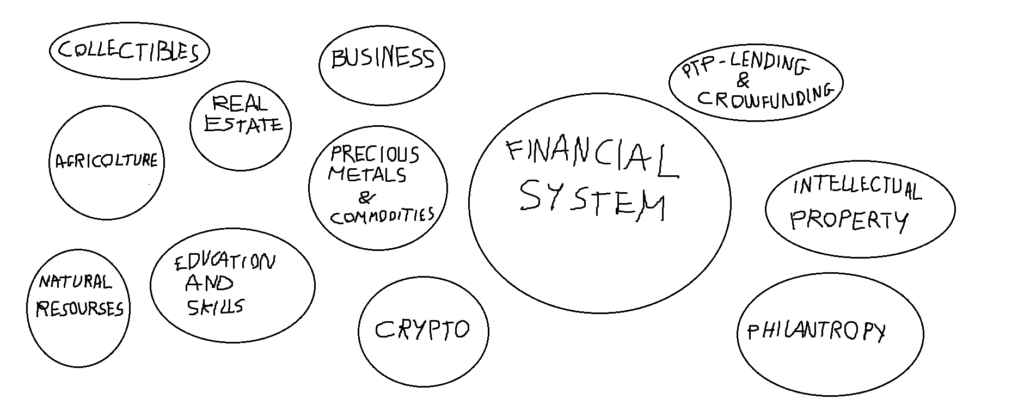

I turns out you can invest in many things. The investment universe:

It’s a multiverse, similar to the marvel one.

Personally I’m investing in business, in real estate, in the financial system (stocks and bonds), crypto, crowfunding but first of all in education and skills. I do not know the others universes.. for now.

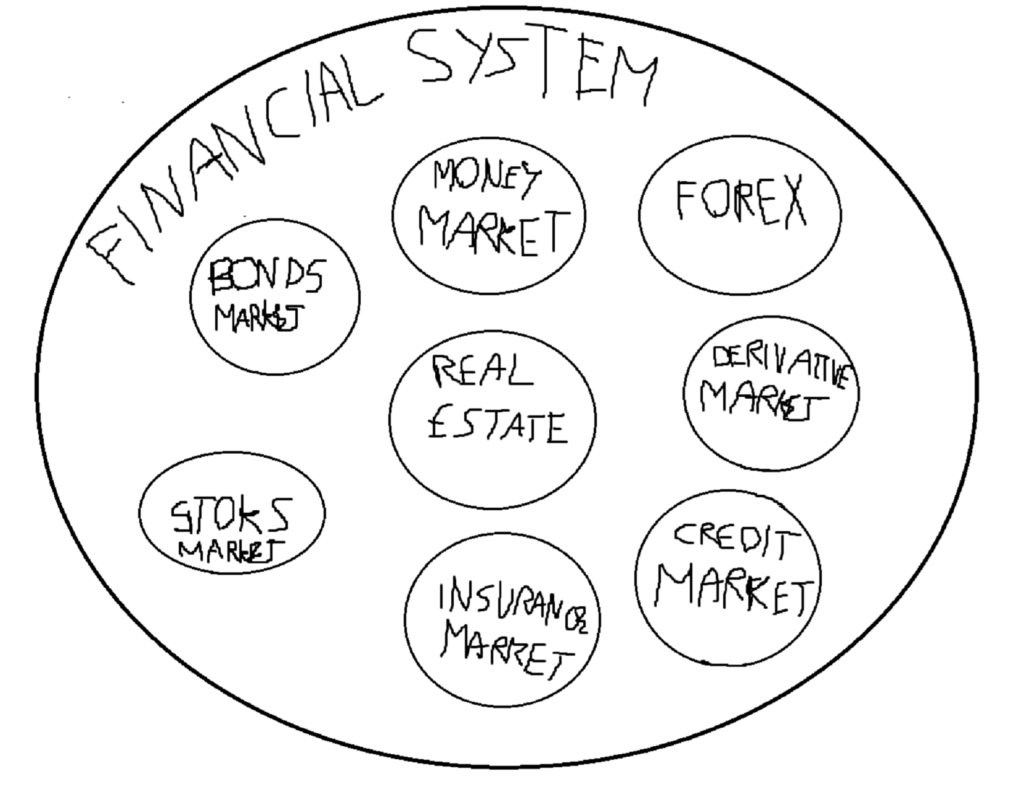

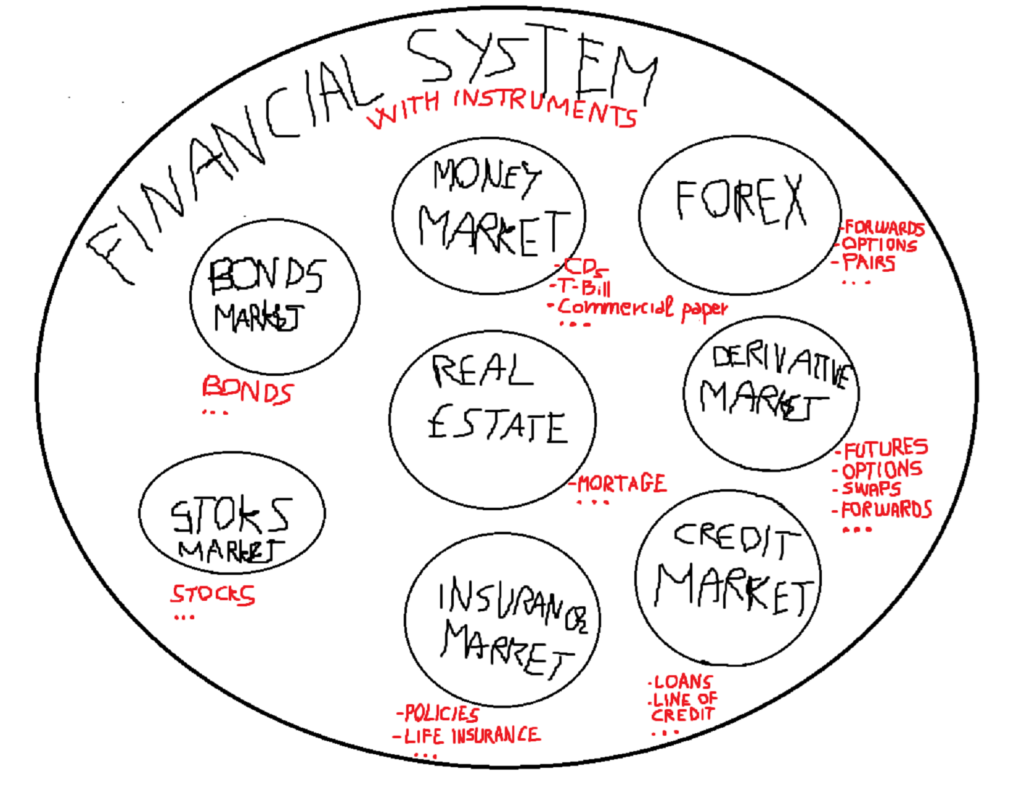

In this multiverse let’s see brake down the circle of the financial system:

Ok. There are a lot of confusing name here. Let’s not be afraid of it. We will disassembled it. Piece by piece in some future articles.

For now we must know that every circle inside the financial system has it’s own instruments, here in red:

Better investing in the financial system or outside of it? Or both? Again it depends. Depends on where you are in life. Depends on your short term and long term goals. Depends on your knowledge and others factors..

The financial system from the outside seems a big mess with people playing with other people debts. But it’s not all like this.. camon.. there has to be something good in it? . . . .

Why society need a financial system in the first place?

There are a lot of reason for that. Just for listing the main ones: better allocation of resources from savers to borrowers, give to individuals investment opportunities (something that did not exist some time ago), give access to money when someone need it, diversify risk ecc

It’s a way to invest in the productivity of the human race we can say.

For example, when I buy a stock I’m buy a piece of a company, which is the work of some humans. When I buy a bonds I simply lend some money to a company or a state, and they will give me those money back one day with some interest.

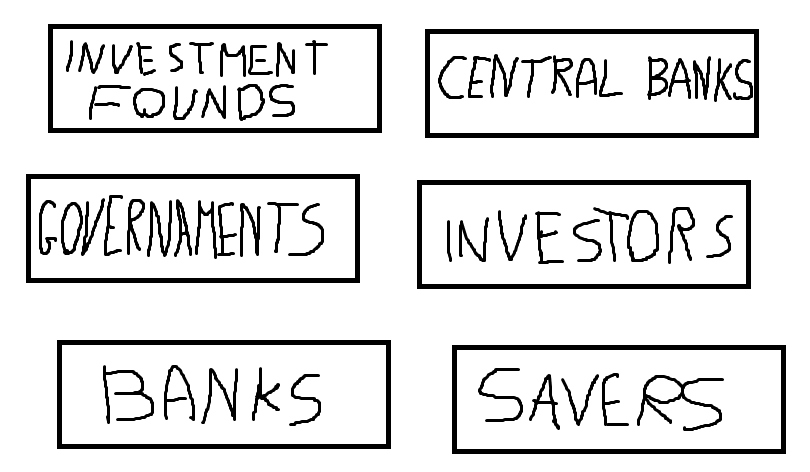

Ok.. and who play in the financial system? The financial subjecs!

I’m a saver, who is investing something. Every subject here has it’s own scope and roles. Again my future self will analize these subject one by one..

For now we can say that there are makets, each with it’s own instruments. And subjects who operate in this market by buying and selling those instruments. It seems easy.

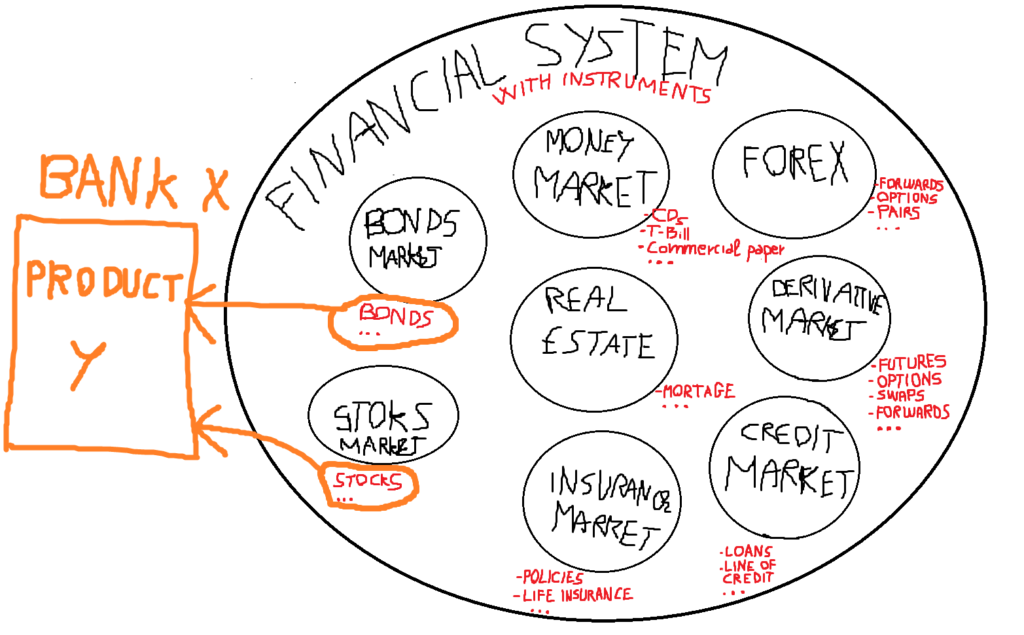

At complicating things, there are the financial products which usually have confusing names.

For example, what a bank can do is to take some instruments, put them togheder and create a financial product with a name.

For example a bank X can sell to you a financial products Y compose of some financial instrument like bonds and stocks. When you go to a bank it’s like going to the super market, exept that you go in a bank to buy the bank products. Of course for using their product you pay some commissions.

Come to Bank x for buying product y, there is a discount your for you, if you buy it now!

So my questions are, can I buy financial instruments by myself without a middleman (the bank)? Which are the strategies that will help me allocate better the resources in this system?

What things the banks want to sell to me? it’s good for me?

Guys for this first post it’s all.. I know that probably I wrote something that can be wrong. Please correct me in case!

Thank you in advance and I’m looking forward for your comments!

Teo

The website design looks great—clean, user-friendly, and visually appealing! It definitely has the potential to attract more visitors. Maybe adding even more engaging content (like interactive posts, videos, or expert insights) could take it to the next level. Keep up the good work!

Hello, thank you for the comment. New post out soon! The goal is to make financial education simple to understand